U.S. Sports Betting Industry Hits Historic High in 2024: Key Trends and Insights

The U.S. sports betting industry achieved record-breaking revenue in 2024, driven by digital growth and expanding state legalization. Explore the latest trends and insights.

The U.S. sports betting industry continued its meteoric rise in 2024, setting new records with $13.71 billion in revenue, a significant jump from 2023's $11.04 billion, according to the American Gaming Association (AGA). Legal sportsbooks handled nearly $150 billion in wagers, marking a 22.2% increase from the previous year. The industry's national hold rate rose slightly to 9.3%, up from 9.1% in 2023.

Record-Breaking Quarter

The fourth quarter of 2024 was particularly lucrative for the industry, generating $3.66 billion, a 7.3% increase over the previous record set in Q4 2023. This growth occurred despite NFL favorites performing exceptionally well during the season, which typically attracts heavier betting activity.

Digital Dominance

Online platforms continued to drive the industry's expansion, with 30% of all commercial gaming revenue coming from digital sources in 2024, up from 25% in 2023 and 13% in 2021. David Forman, AGA vice president of research, highlighted the shift:

'These past few years have reshaped the industry. While the revenue pie is much bigger, it looks very different than it used to, driven by new online gaming options available to more people than ever before.'

State-by-State Growth

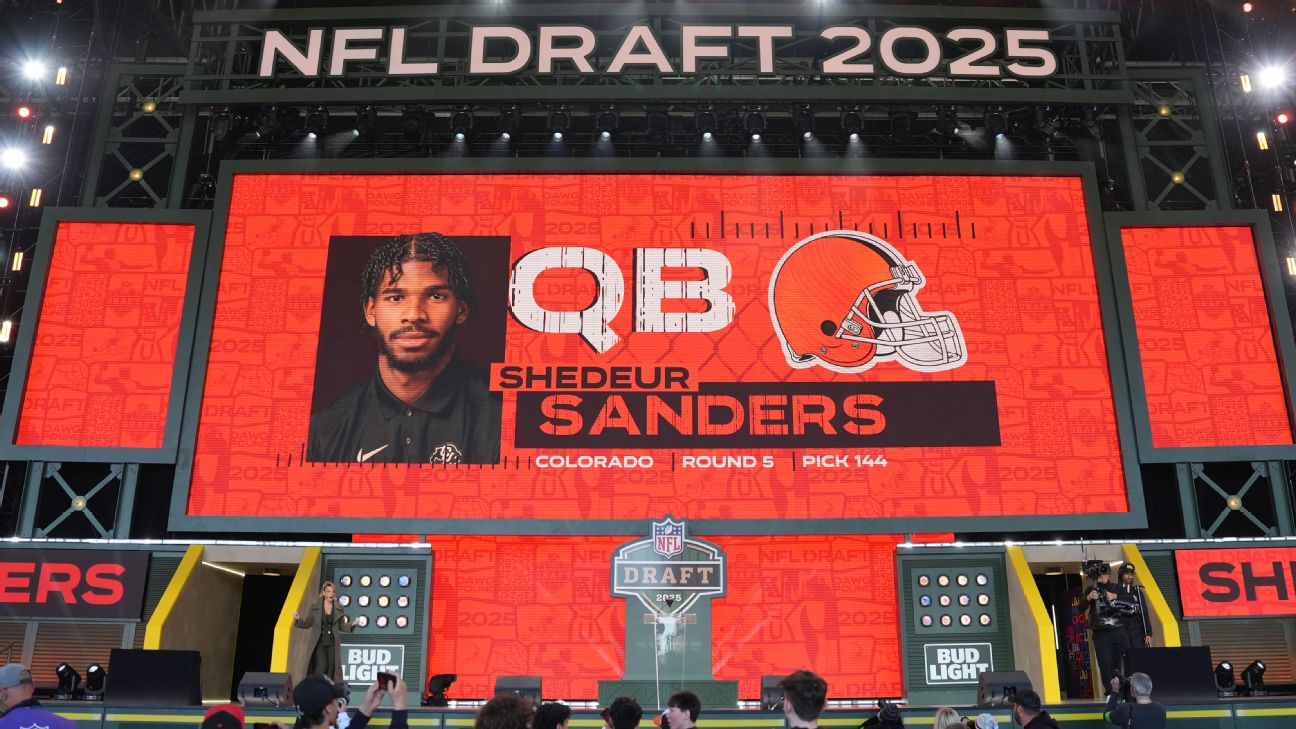

As of February 2025, 38 states and Washington, D.C. have legalized sports betting in some form, with 24 jurisdictions offering full online sports betting. New states like North Carolina and Vermont contributed to the record revenue in their debut year.

New York remained the largest sports betting market, generating $2.1 billion in revenue, while Illinois overtook New Jersey to become the second-largest market. Both Illinois and New Jersey surpassed $1 billion in annual sports betting revenue for the first time.

Looking Ahead

The industry is poised for further growth in 2025, with Missouri expected to launch its sports betting market by mid-to-late summer following its legalization via a ballot initiative. Existing markets like Massachusetts and Maryland also showed strong growth, with revenue increases of 40% and 23%, respectively.

Forman emphasized the importance of attracting new users: 'A lot of the growth was driven by existing markets. We’re seeing new people enter the ecosystem while continuing to engage with those already betting on sports.'

Conclusion

The U.S. sports betting industry is thriving, fueled by digital innovation and widespread state legalization. With new markets on the horizon and existing ones expanding, the industry shows no signs of slowing down.